27+ paycheck calculator hawaii

This Hawaii hourly paycheck calculator is perfect for those who are paid on an hourly basis. Hawaii Paycheck Calculator Frequently Asked Questions How do I use the Hawaii paycheck calculator.

50 Free Editable Bank Statement Templates Statement Template Bank Statement Document Sharing

Simply enter their federal and state W-4 information as well as their pay rate deductions and benefits and well crunch the numbers for you.

. Hawaii Hawaii calculators Hawaii tax rates Hawaii withholding forms Hawaii Salary Paycheck Calculator Gusto The calculators on this website are provided by Symmetry Software and are designed to provide general guidance and estimates. Hawaii is subject to a 12-tax band variable income tax system. If youre a new.

Web Use Gustos hourly paycheck calculator to determine withholdings and calculate take-home pay for your hourly employees in Hawaii. Paid by the hour. Common pre-tax contributions include a health savings account HSA retirement accounts like a 401k or commuter benefits.

This marginal tax rate means that. Web This is money that comes out of your pay before income tax does. Web By using Netchexs Hawaii paycheck calculator discover in just a few steps what your anticipated paycheck will look like.

Well do the math for youall you need to do is enter the applicable information on salary federal and state W-4s deductions and benefits. Finally if you pay for health insurance for you your spouse andor your children through your employer that money will come out of your paycheck. Just enter the wages tax withholdings and other information required below and our tool will take care of the rest.

The 2023 tax rates range from 17 to 62 on the first 56700 in wages paid to each employee in a calendar year. State Income Tax rates range from 140 to 11 with zero local income tax. Web As an employer in Hawaii you have to pay unemployment insurance to the state.

Web tool Hawaii paycheck calculator Payroll Tax Salary Paycheck Calculator Hawaii Paycheck Calculator Use ADPs Hawaii Paycheck Calculator to estimate net or take home pay for either hourly or salaried employees. Web If you make 70000 a year living in the region of Hawaii USA you will be taxed 14386. Switch to salary Hourly Employee.

Figure out your filing status work out your adjusted gross income Net income Adjustments Adjusted gross income calculate your taxable income Adjusted gross income StandardItemized deductions Exemptions Taxable income. Overview of Federal Taxes When your employer calculates your take-home pay they will withhold money for federal and state income taxes and two federal programs. Web Calculating your Hawaii state income tax is similar to the steps we listed on our Federal paycheck calculator.

Web Enter your employment income into the paycheck calculator above to estimate how taxes in Hawaii USA may affect your finances. Switch to hourly Salaried Employee. Web To calculate your net pay or take-home pay in Hawaii enter your period or annual income along with the required federal state and local W4 information into our free online payroll calculator.

Once done the result. Youll then get your estimated take home pay an estimated breakdown of your potential tax liability and a quick summary down here so you can have a better idea of what to possibly expect when planning your budget. Take home pay is calculated based on up to six different hourly pay rates that you enter along with the pertinent federal state and local W4 information.

Your average tax rate is 1198 and your marginal tax rate is 22. Web The Hawaii salary paycheck calculator will calculate the amount of income tax per paycheck. See payroll calculation FAQs below.

It will calculate net paycheck amount that an employee will receive based on the total pay gross payroll amount and employees W4 filing conditions such us marital status payroll frequency of pay payroll period number of dependents or federal and. Simply follow the pre-filled calculator for Hawaii and identify your withholdings allowances and filing status. Web Hawaii Hourly Paycheck Calculator.

Web Use SmartAssets paycheck calculator to calculate your take home pay per paycheck for both salary and hourly jobs after taking into account federal state and local taxes. Web Hawaii Paycheck Calculator Payroll check calculator is updated for payroll year 2023 and new W4. Web Use Gustos salary paycheck calculator to determine withholdings and calculate take-home pay for your salaried employees in Hawaii.

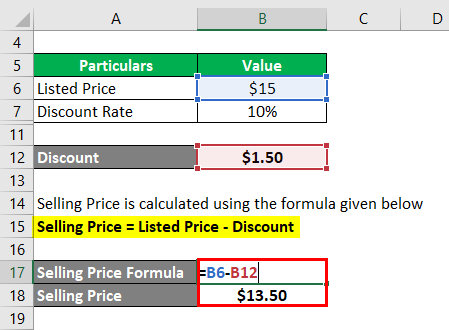

Discount Formula Calculator Examples With Excel Template

18 Apps For Effortless Money Saving Budgeting Investing

Pdf A T Business Management Review December Edition 2012 Makarand Upadhyaya Academia Edu

10 Best Realtors In Texas 2023 Rankings Houzeo Blog

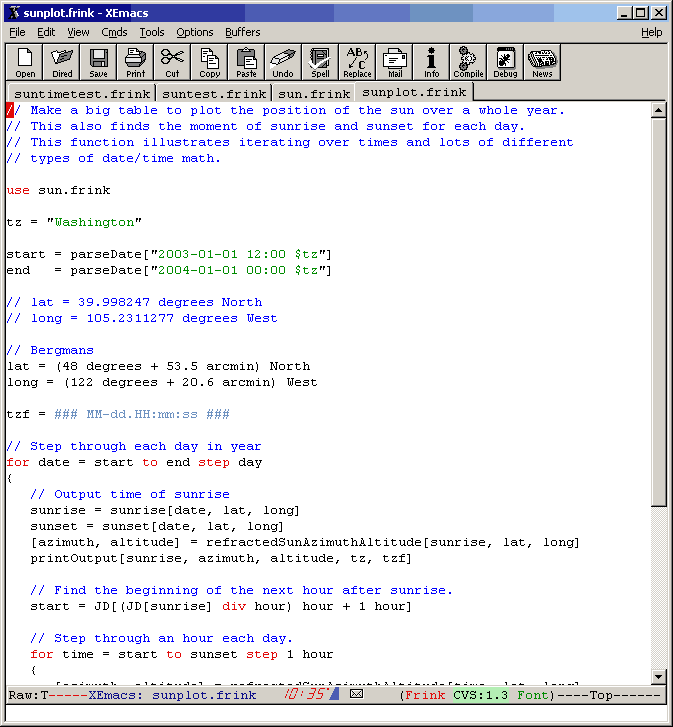

Frink

O Dwyer S October 2022 Healthcare Medical Pr Magazine By O Dwyer S Pr Publications Issuu

Research Early Childhood Daniel Asante Academia Edu

Paycheck Calculator Take Home Pay Calculator

Pin By Social Media Marketing On Places To Visit 1099 Tax Form Fillable Forms Tax Forms

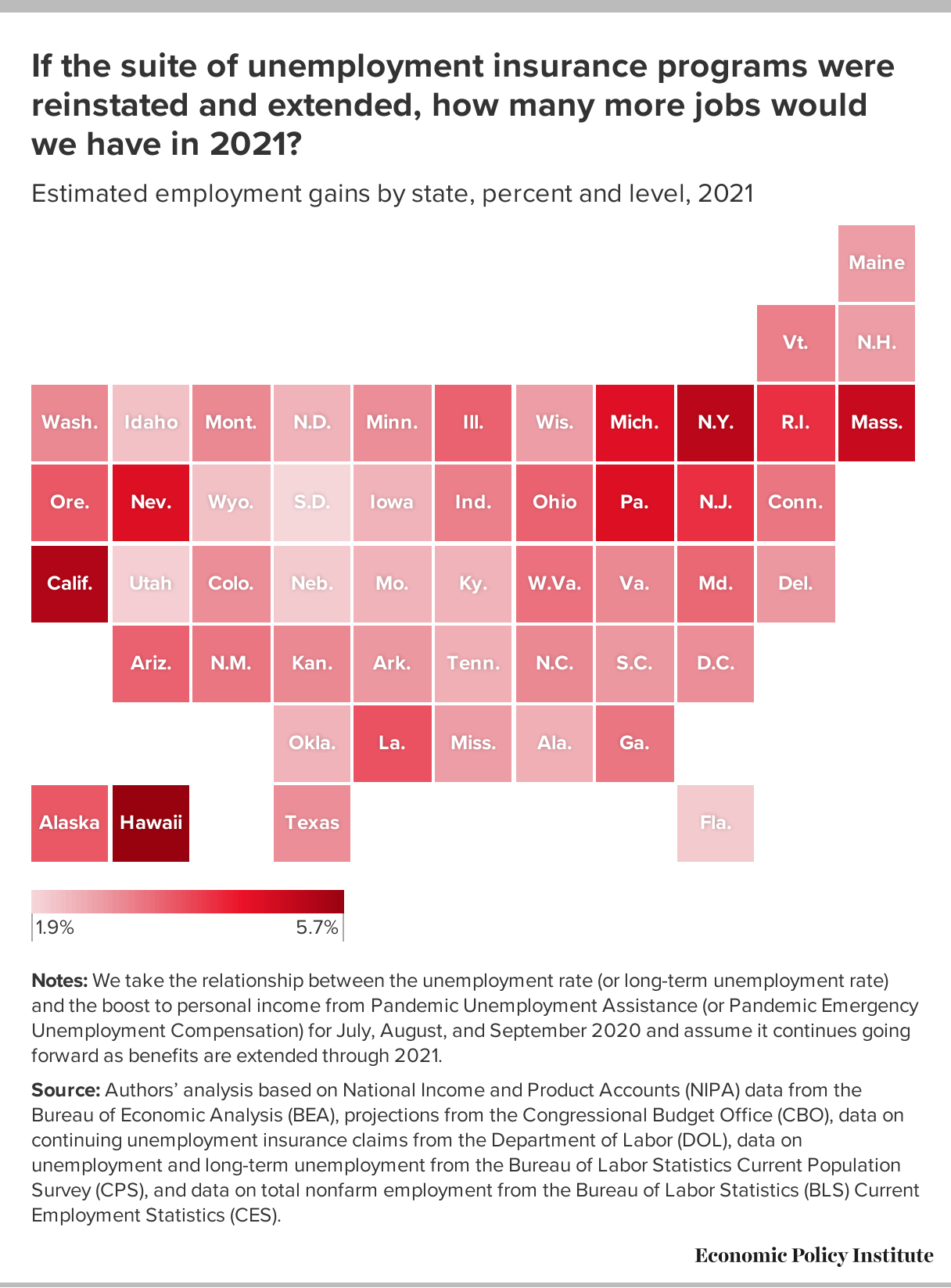

Reinstating And Extending The Pandemic Unemployment Insurance Programs Through 2021 Could Create Or Save 5 1 Million Jobs Economic Policy Institute

Uah Global Temperature Update For April 2017 0 27 Deg C Roy Spencer Phd

Free Payroll Tax Paycheck Calculator Youtube

Hawaii Paycheck Calculator Smartasset

Paycheck Calculator Take Home Pay Calculator

Esmart Paycheck Calculator Free Payroll Tax Calculator 2023

Rnn Crf Tf Test Word Seq Txt At Master Efikarra Rnn Crf Tf Github

Here S How Much Money You Take Home From A 75 000 Salary